MOSCOW – On Wednesday, Reuters reported the details of a private and “secret” deal reached between Russia and Saudi Arabia, a deal that was aimed at increasing oil output in order to offset the coming shock to oil prices that will follow U.S. efforts to starve Iran of its oil revenues. Notably, Reuters also noted that the deal was struck with cooperation from the United States, even though Russia had publicly attacked the U.S.’ targeting of Iran via sanctions and had pledged to help protect Iranian trade to help keep the country’s economy afloat.

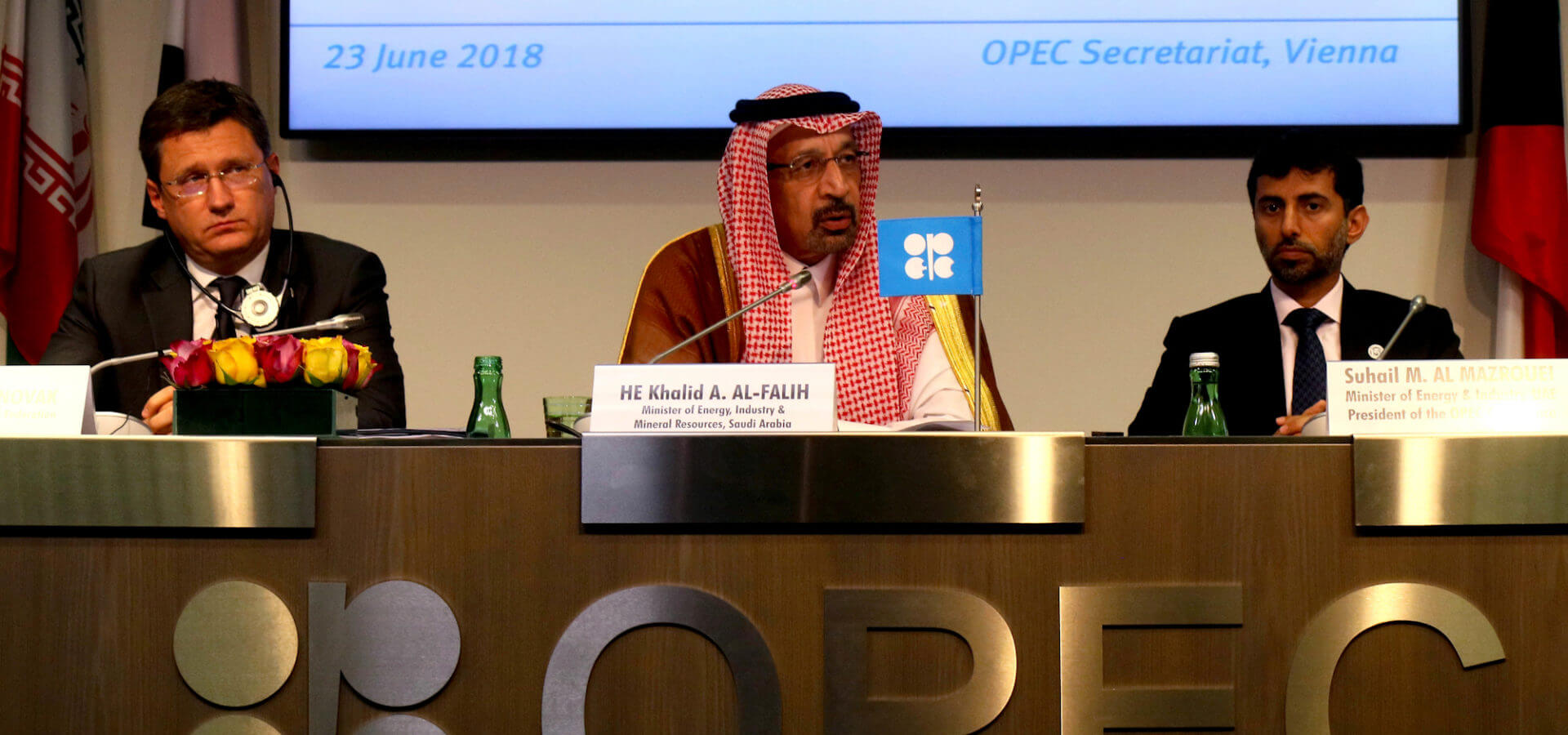

The private deal was reached in September between Saudi Energy Minister Khalid al-Falih and his Russian counterpart Alexander Novak, along with coordination from U.S. Energy Secretary Rick Perry. One of the sources that spoke to Reuters asserted that “the Russians and the Saudis agreed to add barrels to the market quietly with a view not to look like they are acting on Trump’s order to pump more.” The deal was struck as oil prices began to climb towards $80 per barrel. The oil price currently stands at just over $84.

Russia’s involvement in the deal may seem surprising given that Russia publicly vowed in August to do “everything necessary” to protect its shared economic interests with Tehran — including the estimated $50 billion in Russian investments in Iran’s oil sector that Russia has said will continue despite U.S. plans to sanction the Iranian oil and gas sectors beginning on November 4.

The revelation that Russia worked privately with the Saudis “on Trump’s order” to aid the U.S. effort to halt Iranian oil exports without causing a supply shock seems to contradict Russia’s public promise to defend Iran’s economy against aggressive U.S. sanctions. Indeed, by helping the U.S. to avert a supply shock following the November 4 deadline, Russia may actually enable the U.S.-led sanctions campaign to be successful and longer lasting than it would be without Moscow’s support.

The U.S. decided to impose the sanctions after unilaterally withdrawing from the Iran nuclear deal, or Joint Comprehensive Plan of Action (JCPOA), in a move that was rejected by the deal’s other signatories.

Russian motives for aiding the U.S. and the Saudis

While Russia’s involvement in brokering this no-longer-secret deal with the Saudis seems to contradict its own geopolitical interests and public statements, there are a few motives that seem to explain the Russian decision to aid the U.S. effort to offset a coming supply shock resulting from the removal of Iranian oil from the global market.

On the one hand, Russia’s oil sector stands to benefit economically by increasing its oil exports and thus increasing sales. This push to up supply at the U.S.’ behest has already had lucrative consequences for the Saudis, so it is likely that economics and the promise of increased oil sales may have pushed Russia to cooperate in private with the U.S. effort to increase the oil supply from countries other than Iran.

The move could also be part of an effort by Moscow to make global oil policy bilaterally with the Saudis, which began a few years ago and has largely decreased the effectiveness of OPEC, of which Iran is a member. Indeed, knowing that the Saudis were already pushing up their output at the U.S.’ behest, it is possible that Russia wanted to cement its key role in this newly emerging “OPEC of two.” Unsurprisingly, when news of the “secret deal” broke, Iran accused Saudi Arabia and Russia on Wednesday of breaking OPEC’s agreement on output cuts.

However, another more pressing reason could be concern about how increased oil prices, particularly oil prices crossing the $100 per barrel threshold, may affect the global economy. Indeed, some well-regarded analysts have warned that if oil prices reach $100, it could lead to a global economic collapse and a collapse of the equity market. Yet, if a supply shock is prevented with Russia’s cooperation and the price of oil then stays below $100, those potential economic catastrophes may be averted.

Keeping oil prices below $100 per barrel may have been the deciding factor after all as the very release of the Reuters report that exposed the private Russia-Saudi deal led to a drop in the price of oil (albeit a small one). This led some analysts to suggest that the details of the deal were intentionally leaked in order to keep the price of oil from continuing to climb ahead of the November 4 deadline.

Regardless of Russia’s reasoning for privately cooperating with the Saudis and the U.S. to make the effort to starve Iran of its oil exports feasible, it is highly unlikely that either Russia or the Saudis will be able to prevent the coming supply shock after November 4. Indeed, just recently, China – which like Russia had vowed to aid Iran in resisting U.S. sanctions – “caved” to U.S. pressure, after its top oil importer Sinopec announced last week that it would reduce its Iranian oil imports by half. With China, the world’s largest importer of oil, set to wind down its imports of Iranian oil, a supply shock is all but guaranteed and, with it, $100 oil.

Top Photo | Russian Minister of Energy Alexander Novak, Khalid Al-Falih Minister of Energy, Industry and Mineral Resources of Saudi Arabia and Minister of Energy of the United Arab Emirates, UAE, Suhail Mohamed Al Mazrouei, from left, attend a news conference after a meeting of the Organization of the Petroleum Exporting Countries, OPEC, and non OPEC members at their headquarters in Vienna, Austria, June 23, 2018. Ronald Zak | AP

Whitney Webb is a staff writer for MintPress News and a contributor to Ben Swann’s Truth in Media. Her work has appeared on Global Research, the Ron Paul Institute and 21st Century Wire, among others. She has also made radio and TV appearances on RT and Sputnik. She currently lives with her family in southern Chile.