Eight years into the deepest economic depression that an industrialized country has ever experienced, we are now being told that Greece is a “success story.” Having accepted the “bitter medicine” prescribed by the “troika”—the European Commission, the European Central Bank, and the International Monetary Fund—the storyline today is that Greece is on the road to recovery, firmly within the European Union and the eurozone.

This narrative was recently echoed by Greek Prime Minister Alexis Tsipras in his annual speech at the Thessaloniki Trade Fair, Greece’s equivalent to the State of the Union address. In this speech, Tsipras triumphantly declared that talk of “Grexit”—or a Greek departure from the eurozone and the EU—has been replaced by that of “Grinvest.”

Within such a context, there is seemingly no room for discussions about whether it is in Greece’s best interest, even after so many years of implementing the troika’s austerity diktats, to consider a departure from the eurozone and the EU. Indeed, the narrative is that the people of Greece overwhelmingly have never supported the prospect of “Grexit.”

All throughout the economic crisis in Greece, it has been reported that polls have consistently shown clear majorities favoring the country’s “European trajectory” and rejecting the possibility of a departure from the eurozone and EU.

So the Greeks want the euro at all costs, even if it means more harsh austerity measures and cuts to wages, pensions and social services. Or so we are told. These claims would be believable if they were the product of robust public debate and deliberation on the respective pros and cons of remaining within the “European family” or departing. But in Greece, and in most of the global mainstream media, there is no such debate and never has been.

Instead, what has taken place in Greece during the economic crisis has been the complete elimination from public debate of opponents of the prevalent economic and political doctrines. Those who oppose the eurozone, the EU, or simply the austerity measures, are stamped with the “scarlet letter” of being “nationalists,” “xenophobes,” or “fascists.” Such rhetoric became even more polarized following the Brexit referendum result. The Brexit result and the rise of “populism” have themselves been demonized, while poll results that contradict the mainstream narrative are habitually buried by the supposedly “objective” major media outlets.

Following the first installment of this series –in which the less-than-democratic roots of the EU, the zeal with which the EU is lionized by the global media today, the EU’s present-day democratic deficit and hypocrisy, and the attempts to discredit opponents of the EU and neoliberalism were analyzed–this piece will focus on what has long been the “elephant in the room” in Europe: the possibility of departure from the eurozone and from the EU, and why it must, at the very least, be debated on equal terms in economically suffering countries such as Greece.

Fostering fear and lies

Throughout the crisis, the austerity measures that have been imposed on Greece, the arguments in favor of the necessity of remaining “in Europe,” the mythos surrounding the “European dream,” and the horror that would result from “Grexit” have been propped up by a series of lies and scare tactics that have been repeatedly propagated by politicians and media outlets alike.

This has fostered a form of learned helplessness in Greece, a belief that the country is incapable of surviving outside the eurozone and EU and therefore must remain, even if the preconditions for doing so are harsh.

One such myth pertains to the idea that Greece “doesn’t produce anything” and is therefore reliant on imports. These imports must, of course, be paid for with hard currency; therefore, the conventional line of thinking suggests that Greece would be unable to import vital necessities with its own “soft” currency.

Case in point: a 2012 Eurobarometer survey found that 94 percent of Greeks were concerned about national food security, the highest level in the EU. In addition, Greece was the only EU member-state where a majority (61 percent) expressed concern with national food production. Moreover, 79 percent of Greeks expressed the belief that Greece does not produce enough food to meet domestic needs. Again, this was the highest percentage recorded in the EU.

The claim that Greece doesn’t produce anything and is not nutritionally self-sufficient is constantly repeated by the media and used to justify remaining in the common market, but is it true? As of 2010, the most recent year for which complete statistics seem to be available, Greece met, exceeded, or came close to meeting domestic demand for staples such as eggs, meat and milk derived from sheep and goats, olive oil, several crops (including oranges, peaches, tomatoes, cucumbers, apricots, potatoes, and grapes), honey, whole grains, and poultry.

Furthermore, according to data from 2012, Greece is second worldwide in the production of sheep’s milk, third in olive and olive oil production, fourth in the production of pears, fifth in the production of peaches and nectarines, sixth in pistachio production, and in the top ten in goat’s milk, chestnuts, cantaloupes, cherries, and cotton. It is also just outside the top ten in the production of almonds, cottonseed, asparagus, figs, and other legumes. Greece is third in the world in the production of saffron and sixteenth in the world in the production of cheese products.

Outside of food production, Greece is a strong producer of such resources as aluminum and bauxite (first in Europe), magnesium (meeting 46 percent of Western Europe’s production), second in the world behind the United States in the production of smectite clay, and is the only European country with significant nickel deposits. Greece is also a significant producer of laterite and marble, as well as steel and cement.

Outside of production, Greece possesses one of the world’s largest shipping fleets, ranking second worldwide in total tonnage, while the Greek flag fleet and merchant fleet rank second in the EU and seventh globally. In addition, Greece is fourteenth in the world in tourist arrivals (but twenty-third in tourist revenue).

It is these three sectors — agriculture, shipping, and tourism — that have traditionally sustained the Greek economy, alongside domestic small businesses, which themselves have suffered during the crisis under the weight of decreased spending and increased taxation. Prior to the euro, the agricultural, shipping, and tourism sectors provided Greece with the hard currency with which it financed imports.

Related | Greece: A (Basket) Case Study In Savage Globalization

Indeed, it is membership in the EU that has led to a sharp decline in the domestic production of numerous staples in Greece. In 1961, twenty years before joining the EU, “impoverished” Greece produced 169,200 tons of figs, 6,374 tons of sesame, 52,000 tons of dry beans, 13,365 tons of chickpeas, and 19,246 tons of quince. In 2011, the respective figures were 9,400 tons of figs, 33 tons of sesame, 22,744 tons of dry beans, 2,200 tons of chickpeas, and 3,432 tons of quince.

In 1981, the year Greece joined the EU, production of fresh vegetables was at 123,298 tons, lemon production was at 216,874 tons, apple production was at 337,091 tons, almond production at 73,181 tons, tobacco production at 130,900 tons, tomato production at 1,884,600 tons, and potato production at 1,056,000 tons.

Thirty years later, the figures for each of these crops had sharply declined: 74,393 tons of fresh vegetables, 70,314 tons of lemons, 255,800 tons of apples, 29,800 tons of almonds, 20,287 tons of tobacco, 1,169,900 tons of tomatoes, and 757,820 tons of potatoes.

A major factor in this decline is the EU’s common agricultural policy, which sets production quotas for each country and each sector of production, and dictates to each country what to produce and which crop varieties to cultivate, what not to produce, where to export, where not to export, how much to export and at what price.

For example, until 2005 Greece’s sugar production sector was profitable and met a large part of domestic demand. In a 2006 deal with the EU, however, Greece agreed to reduce its domestic sugar production and increase imports. In 1980, the year before Greece ascended to the EU, pork meat production met 84 percent of domestic needs, while beef production met 66 percent of domestic demand. Those figures have declined to 38 and 13 percent, respectively.

The decline in beef production has also impacted the dairy sector. The EU’s influence is evident here as well: in 2000, Greece was fined 2.5 billion drachmas (over 7.3 million euros) for exceeding EU-imposed quotas for the production of cow’s milk.

And yet the myth persists: Greece “cannot survive” outside of the eurozone and EU. And while the lack of production—whether imagined or real—is one of the main arguments used by proponents of remaining in the EU, the lies do not stop there.

Greece wants to stay in the eurozone and EU — or does it?

One of the most prevalent and recurring myths to come out of crisis-stricken Greece is that despite the austerity measures and cuts that the Greek people have been faced with, the overwhelming majority wishes to remain in the EU “at all costs.”

This exact wording has been used in numerous public opinion polls, such as one published on July 5, 2015, the day of the Greek referendum on whether to accept or reject a new troika-backed austerity proposal. According to this poll, conducted by polling firm GPO on behalf of one of Greece’s most notoriously pro-austerity TV stations, Mega Channel, 74.1 percent of respondents wished to remain in the EU at all costs.

Is this really the case? It is worth considering that in Greece, there are no polling firms which conduct public opinion polls independently. Surveys are conducted on behalf of large media outlets which are, without exception, favorable to the policies of austerity and continued membership in the eurozone and the EU. The polling firms themselves also belong to similarly entrenched interests. The aforementioned GPO, for instance, was co-founded by construction and publishing magnate Christos Kalogritsas, who is said to still maintain a close friendship with GPO’s main shareholder, Takis Theodorikakos.

Related | How Greece Became A Guinea Pig For A Cashless, Controlled Society

Further limiting their independence, Greece’s major public opinion polling firms are all recipients of state funding. Between 2010-2013, Kapa Research received 3,126,900 euros, MRB received 877,423 euros, GPO received 395,003 euros, Metron Analysis received 273,574 euros, Marc received 82,650 euros, VPRC received 55,500 euros, and ALCO received 50,677 euros.

Despite this though, the question remains: are the polling results accurate? What has been evident throughout the crisis is that poll results have often been woefully inaccurate. For example, prior to the 2015 referendum, major public opinion polls showed “yes” and “no” in a statistical dead heat. In reality, over 61 percent of voters rejected the EU’s austerity proposal, even if this result was itself overturned by Greece’s subservient SYRIZA-led government, which itself seemingly wishes to keep Greece inside the eurozone and EU “at all costs.”

More evidence can be found from the results of the few relatively independent public opinion polls which have taken place in Greece in recent years. For example, in a pan-European survey conducted by the Gallup International polling firm in December 2014, 52 percent of Greeks favored a return to a domestic currency, while only 32 percent favored remaining in the eurozone. Notably, Gallup International’s respective 2016 end-of-year poll found less than overwhelming support in Greece for remaining in the EU: while 54 percent of respondents stated that in a hypothetical referendum they’d vote to remain, 46 percent would vote to leave.

Furthermore, a March 2015 poll by Bridging Europe—an upstart polling firm which has since openly and unabashedly supported SYRIZA—found that 53 percent of respondents favored a return to a domestic currency. Together, these results contradict polling results which claim that overwhelming majorities of Greeks wish to remain, and at all costs to boot. However, these poll results have never been reported by either the Greek or the international media.

What the mainstream public opinion survey results in Greece aim to accomplish is threefold. First, they seek to impact public opinion in Greece by making it seem like there is such an overwhelming majority in favor of continued EU and eurozone membership that resistance is futile—and the product of “fringe” elements of society. Secondly, it impacts the international media in their reporting on Greece and the crisis, as they regurgitate these poll results without question.

Third, it reinforces the pro-EU, pro-euro, pro-austerity politics enforced by Greece’s current and previous governments, and the respective pro-EU and pro-euro positions of the entirety of the political spectrum that is represented in parliament.

Varoufakis: more blatant lies and pro-EU propaganda

When concealing inconvenient public opinion survey results isn’t enough, more blatant lies are employed. A characteristic example comes from the statements made by former finance minister and “heroic” celebrity economist Yanis Varoufakis, who in an interview with ABC Radio in Australia in 2015 stated that even if Greece wanted to return to a domestic currency, its printing presses were destroyed in 2000 prior to joining the eurozone. In reality, Greece’s mint is still in operation in the Athens suburb of Holargos and prints euro banknotes today.

In the minds of many Greeks, the old drachma is also associated with crippling inflation and economic instability, a perspective which the major media outlets have done nothing to dispel. Listening to certain Greeks discussing the pre-2002 era, one would think that prior to the euro Greeks must have lived in caves, without electricity, automobiles, or running water—and that such days will swiftly return if Greece dares to depart from the common currency.

Particular fears are expressed about inflation. However, this ignores the fact that from the 1950s through the early 1970s, inflation in “impoverished” Greece hovered at or below 5 percent. In the late 1990s, as Greece prepared to meet Maastricht criteria to join the eurozone, inflation once again fell into the single digits. Throughout the 1970s, 1980s, and 1990s, other southern European countries, such as Italy and Spain, also frequently attained double-digit inflation levels similar to those seen in Greece.

When all else fails, stereotypes and collective guilt are employed to great effect. Greece lied in order to enter the eurozone, we are told, and therefore is reaping its just rewards. But as was pointed out in the first installment of this series, other countries such as Spain and Italy performed similar accounting tricks, but no similar calls to “punish” these countries have been heard.

Related | Neoliberal Echoes Of A Darker, Mid-Century Plan For Continental Unity

What is heard though, by both the Greek and international media, is that the Greek people “lived beyond their means.” This viewpoint is consistent, whether you consult with the “leftist” Guardian, the right-wing Daily Telegraph, German finance minister-for-life Wolfgang Schäuble, or former EU economy commissioner Ollie Rehn. The head of the Eurogroup—the committee of eurozone finance ministers—and member of Holland’s Labour Party Jeroen Dijsselbloem stated earlier this year that Greeks spent their money on “drinks and women.” In turn, Dutch “eurosceptic” politician Geert Wilders claimed that Greeks spent their money “on souvlaki and ouzo.”

Never mind that Greece’s private sector debt has consistently ranked at the lowest levels among OECD countries and still does today. This has not stopped the Greek media and Greece’s politicians from repeating such claims, ascribing collective blame to the entire populace when it was a small cohort of politicians and crony capitalists who largely benefited from the public spending bonanza and augmentation of Greece’s public debt.

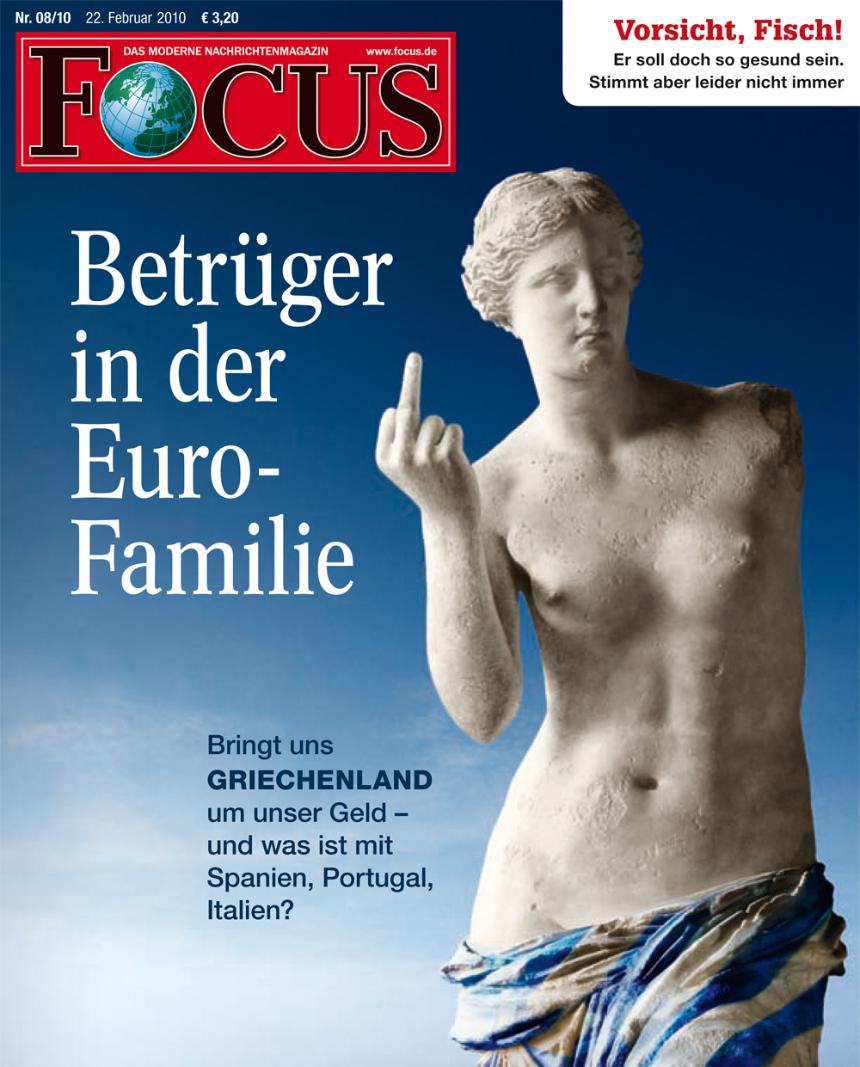

Nevertheless, such statements are coupled with heavy doses of racism from Greece’s “European partners.” In 2010, the “reputable” German magazine Der Spiegel published, on its front cover, an image of the goddess Aphrodite, cloaked in a Greek flag, giving the finger to Europe, accompanied by the headline “Swindlers in the euro family.” Two studies, commissioned by the Hans Böckler Foundation and by the German newspaper Suddeutsche Zeitung, have found that German media coverage of Greece’s crisis has been rife with stereotypes, bias, and superficial reporting.

The Feb. 13, 2010 edition of the Wall Street Journal featured a parody of ancient Greek art—now well-concealed on the Internet—displaying an ancient god begging for change. The Telegraph has referred to the crisis in Greece as the “ouzo crisis” while referring to the suffering economies of southern Europe as “Club Med.”

One of the many end results of this constant barrage of disparagement and insults towards the Greek people is that they have become ingrained in the national psyche. A common refrain heard in Greece in reference to anything negative occurring within the country is that “this is who we are.” Greece lied and therefore it must be punished. Greeks lived beyond their means and are now getting their just dues. Greeks were corrupt and “ate it all together,” in the words of ex-politician Theodoros Pangalos, and therefore collectively must share the blame.

Herein lies a paradox: on the one hand, Greeks are consistently ranked as among the unhappiest people in the world. Greece ranked fourth in this year’s Bloomberg misery index, and has been found to be the unhappiest country in Europe by both the Eurobarometer survey and by Gallup International. In such a toxic environment, the prevailing policies of economic austerity, cuts, and privatization are therefore met with tacit acceptance.

Collective guilt has set in for Greece’s supposed sins, and these painful austerity measures—and the misery they bring—are considered an inevitable result of these “sins.” On the other hand, the actors in large part responsible for the austerity that has delivered such misery, such as the EU, continue to receive support from a significant percentage of the population.

As for those who dare to openly speak out against austerity and in opposition to the EU and the eurozone? They are swiftly labeled. A favorite retort in Greece concerns the supposed existence of a “conspiracy of the drachma” in which diaspora Greeks and wealthy Greeks who have moved their money offshore favor a return to the drachma. As this line of thinking goes, these individuals would then move their money back to Greece and take advantage of a sharply devalued local currency, getting wealthier in the process.

Other attacks are simpler, often branding opponents of the prevailing European order as “fascists,” “xenophobes,” “nationalists” and “populists”—the latter two, of course, being rather dirty words in the present-day context.

Related | Economist Mark Blyth On Rising Inequality & Populism

When insults and labels don’t do the job, fear is effective. According to a European Commission adviser and as reported by Newsweek in 2015, Greece would promptly find itself out of oil and medical supplies once it leaves the eurozone and EU. In the lead-up to the 2015 referendum, both Greek and international media outlets, including the Washington Post—which later replaced the image on this article—circulated untrue and undated photos of supermarket shelves devoid of food. Greece’s Mega Channel broadcast images of senior citizens using ATMs in fear—images which actually were from South Africa.

Greek tabloid newspaper Press Star published a “heartbreaking” photo of an elderly man in tears while holding a solitary loaf of bread—even though the photo was actually from the aftermath of the Istanbul earthquake of 1999. The photo was shamelessly recycled one more time earlier this year, in the aftermath of an earthquake on the Greek island of Lesvos.

Another national TV broadcaster, Antenna TV, reported that in the 2015 referendum, Greeks were choosing between a future “as Europe” or “as Zimbabwe.” The same station, prior to the June 2012 parliamentary elections, circumvented a pre-election freeze on political broadcasts by airing, on the eve of the polls, a “documentary” on the (obviously adverse) impacts of “Grexit,” laughably insinuating that a SYRIZA victory would result in “Grexit.”

Never mind that Greek domestic production and industry have been decimated during the years of EU and eurozone membership. Never mind that the EU allowed for the debt of Greece’s national railway to be waived in order to facilitate its privatization—but refuses to allow the same for Greece’s national debt. Never mind that 92 percent of the “bailouts” (loans) Greece has received during the crisis have gone right back to its lenders. Never mind that even EU monies for major infrastructure projects often went right back to European contractors or consultants, in a process of crony capitalism described by former “economic hitman” John Perkins. Never mind that the austerity regime itself has been found to violate the fundamental human rights of the people of Greece. As the title of part one of this series suggested, for the Greek and international media and a substantial portion of the Greek populace, it is “EU über alles”—Europe or bust—even if Greece is the one that goes bust in the process.

The argument for leaving the eurozone and the EU

If we truly support and believe in open and robust public debate, then the discussion as to whether Greece (or any other EU member-state) will be better served by departing from the EU or eurozone must be a part of that dialogue. So far, however, it has largely been excluded from the public sphere and from anything resembling equal footing in public discourse—whether that discussion is occurring in the media, in academia, or in the political arena.

Even if one is not a proponent of leaving the eurozone or the EU, the fiscally and politically prudent thing to do would be to have a plan in place for such a possibility. If, for instance, there is a collapse of the Italian banking system—which is presently teetering on the edge—or some other large-scale economic disaster in the eurozone, it’s not outside the realm of possibility for a domino effect to impact the entirety of Europe, forcing out some eurozone member states or resulting in the collapse of the eurozone system itself.

If this sounds far-fetched, consider the following: there are several examples of currency unions breaking apart, such as that of the Austro-Hungarian empire, or more recently the cases of the breakup of the Czech-Slovak union or Latvia leaving what was essentially a currency union with Russia in 1992.

While not exactly like the eurozone today, in the 19th and early 20th century, the Latin Monetary Union and the Scandinavian Monetary Union attempted to create a currency peg across multiple countries—which also occurred more recently in the lead-up to the launch of the eurozone via the creation of the European Monetary Union. For different reasons, both monetary unions ended up dissolving, with member-states eliminating currency pegs between them.

More recently, the United Kingdom departed the EMU in 1992 amidst doom-and-gloom scenarios highly similar to those heard today about departing the eurozone. Instead, what followed was one of the strongest periods of economic growth in the UK’s history.

Further precedent exists in the well-known examples of Argentina, which repudiated the IMF’s austerity diktats and declared a stoppage of payments on its public debt in 1999. What followed was over a decade of economic growth which exceeded the global average, and indeed even the eventual repayment of much of its previous debt at new terms that it negotiated with most of its creditors.

Iceland, following its banking collapse in 2008 which was, proportionally, the largest collapse sustained by the banking sector in a developed country in history, enacted policies which were in direct opposition to those being recommended by the IMF. Banks were allowed to collapse, foreign creditors were initially not repaid, bankers were jailed. The economy soon boomed, with GDP growth exceeding EU and eurozone averages and Iceland’s GDP eventually eclipsing pre-collapse levels. Meanwhile, a devalued currency led to a tourism and export boom. Eventually, creditors were repaid as well.

Related | Ancient Greece Could Hold The Key To Solving Today’s Debt Crisis

While Iceland and Argentina were not a part of a common currency bloc, their examples highlight how a nation can reject the austerity demands of institutions such as the IMF, can declare a stoppage of payments on its debt, roll back austerity, devalue its currency, and swiftly return to economic growth. Moreover, Argentina broke its 1:1 currency peg to the U.S. dollar — which, while not the equivalent to departing a currency union, had the result of restoring the Argentine government’s ability to enact monetary policy instead of being reliant on U.S. policy.

Therefore, even the most vociferous supporter of “remain” would be well advised to support the development of an exit plan in preparation for a worst-case scenario which may well emerge from outside the country’s borders. Unlike the “heroic” Yanis Varoufakis, who negotiated so fiercely as finance minister in 2015 that he openly stated he had no “plan B” and would not place “Grexit” on the table even as a negotiating tool, such a plan would be the most prudent option even for the most enthusiastically pro-EU regime.

The paragraphs which follow will outline why a country like Greece must consider leaving the eurozone and the EU, the various proposals which have been put forth as to how this could be accomplished, and how a departure could occur.

Why leave?

The euro is essentially a debt instrument: According to economist and former central banker Spiros Lavdiotis, the European Central Bank does not lend directly to its members—i.e. the member states of the eurozone. It instead lends to the private sector, at interest. In turn, the private sector lends to states who seek to borrow money, at higher interest. This perpetuates the debt cycle, while the higher interest is often financed in the form of budget cuts or higher taxes.

Restoring monetary sovereignty – external devaluation instead of internal devaluation: What has taken place during the years of the economic crisis in Greece is essentially a process of “internal devaluation.” This means that the cost of labor in Greece—that is, wages, insurance contributions and the like—have been slashed, purportedly in an attempt to boost the country’s competitiveness.

Traditionally, however, many countries have employed a different remedy for responding to an economic downturn: external devaluation. Instead of cutting wages and pensions at home, the value of the national currency would be devalued, immediately making the country’s exports, services, and labor cheaper and more competitive on a global level, compared to other stronger currencies.

External devaluation also helped foster much-vaunted foreign investment (as the cost of investment would decrease) in economic sectors such as tourism, as the country proceeding with an external devaluation would automatically become cheaper for foreign visitors. With domestic wages, pensions, and social services unaffected, quality of life was largely not impacted by an external devaluation.

The main disadvantage with external devaluation is that the cost of imports rises. This, however, was traditionally offset in two ways: paying for imports with foreign hard currency reserves (which can indeed increase if foreign tourism and investment in the economy increases), and by increasing domestic production, where possible, to alleviate the need for imports. This promoted domestic industry and a policy of full employment.

But today, countries such as Greece are saddled with a hard currency that is overvalued for the needs of the domestic economy, and where there is no level of control on monetary policy. If this seems like a mere unfortunate consequence of the euro, think again: Roger Mundell, the Nobel Prize-winning economist and architect of the euro, foresaw precisely this eventuality.

In Mundell’s vision, as eurozone economies were squeezed with the first sign of an economic downturn, all of the traditional monetary policy tools would be unavailable in their policy-making toolkit. Unable to devalue the currency or to increase deficit spending due to EU rules, governments would be left with one choice: austerity. Cut wages, cut pensions, slash social services to the bone. It’s a neoliberal wet dream—and it is the European “dream” today.

Escaping stifling EU fiscal rules: Currently, EU member-states must abide to strict EU fiscal rules as part of its Stability and Growth Pact. The main rules are that total government debt must not be more than 60 percent of GDP, and government deficits must not exceed 3 percent of GDP.

At face value, this sounds reasonable and prudent. However, the problem with these rules is that they eliminate many of the traditional tools that were available in the fiscal policy toolkit during times of economic recession. Deficit spending, for instance, has enabled many sputtering economies to get back on track, as cash re-enters the economy, encouraging consumer and business spending and private lending. Limiting this ability handicaps countries which are stuck in a recession.

Indeed, one of the primary ideas behind such rules is, quite cynically, to reduce the political cost of what would otherwise be unpopular policies: cuts to social services and pensions and the like.

It should be noted here that leaving the eurozone or even the EU does not mean an automatic green light to act recklessly. But it will afford a country like Greece the freedom to take control of its fiscal and economic policy. Notably, for Greece, the EU has determined that the aforementioned strict rules do not go far enough. Greece’s current “leftist” SYRIZA-led government, entirely subservient to Brussels and Berlin, agreed earlier this year to achieve a primary budget surplus of 3.5 percent annually each year through 2023, and primary budget surpluses of 2 percent annually through 2060.

This certainly contradicts Prime Minister Alexis Tsipras’ current rhetoric regarding the official end of the crisis coming sometime in 2018. A primary budget surplus means that the state spends less than it takes in. For a country with a stagnant or shrinking GDP such as Greece, this means spending an ever-shrinking amount of money. And as government revenues dry up, the surplus target is met by further cutting spending, creating a perpetual austerity death spiral. As of now, this is the economic future Greece faces, no matter what Tsipras, the EU, or the media claim.

Increased competitiveness on the global markets: Free of EU fiscal and monetary shackles, Greece will be free to enact its own policy, including future devaluations of its newly-restored domestic currency (more on devaluation in part three of this series).

When a country such as Greece is ready to take this step and devalue its domestic currency, it will be able to better compete globally in its three cornerstone economic sectors: tourism, agriculture, and shipping. Greece will be a less expensive destination for foreign tourists, while Greek agricultural products and Greek services will be comparatively less expensive. And this will take place via a process of external devaluation, rather than cutting domestic wages and reducing the quality of life.

Greece has an educated and multilingual workforce, as well as lots of untapped or deprecated (due to EU) agricultural potential. Tourism, while increasing in raw numbers, has a lot of potential for growth, especially since average spending per visitor is far less than other countries.

An increase in foreign trade, exports, and tourism will, in turn, ensure that Greece will maintain the necessary foreign hard currency reserves with which it will import vital goods that it cannot produce domestically. This is how the Greek economy operated prior to entering the eurozone in 2002, and it is how even the poorest of states are able to import oil, automobiles, medicine, or other necessities.

Rolling back austerity: Every sector of the Greek economy has been impacted by the austerity measures that have been imposed by Greece’s lenders in the troika since 2010.

Free of a requirement to sustain a primary budget surplus, Greece would have the ability to increase spending in vital social sectors such as healthcare and education, to at least partially restore pensions and salaries that have been repeatedly slashed, and to cut taxes, such as the heating oil tax which has resulted in most Greek households not being able to afford to heat their homes in the winter. Other cuts could be applied to the value-added tax (VAT), which even for many staple items is a hefty 24 percent, as well as high business taxes that are choking the life out of Greece’s traditional economic base of small businesses.

Even without funding coming from the EU, the ability to increase spending could also allow the state to jump-start infrastructure projects or to continue existing public works. Measures could also be financed to reverse the country’s “brain drain” and to attract some of the 600,000 Greeks who have emigrated, back to Greece.

Protecting and promoting industry: Free of the requirements of participating in the European common market, a country like Greece will be less exposed to unequal or unfair competition from industrial powerhouses such as Germany, which has flooded domestic markets with cheap imports, while domestic industries have been shuttered or bought out.

Furthermore, liberated from the requirement of enforcing production quotas under such policy frameworks as the EU’s common agricultural policy, Greece will be able to enact measures to return agricultural production to its much higher pre-EU levels, thereby alleviating many of the concerns regarding the country’s self-sufficiency and “dependence” on Europe for its survival.

Think people don’t want it? Think again: As was shown earlier, public opinion poll results which claim that overwhelming majorities of Greeks wish to remain in the eurozone and EU at all costs are likely “fake news”—meant to influence public opinion and marginalize opposition. What independent polls have indicated is that, at the very least, a departure from the EU and, in particular, the eurozone will not be nearly as unpopular as claimed—and may perhaps even enjoy the support of a small majority.

Leaving the “Hotel California”?

Yanis Varoufakis has famously uttered that the EU (and by extension, the eurozone) are like the Hotel California: you can check out any time you like, but you can never leave. It’s one thing, of course, to understand why a country like Greece—and its economy—may be at a disadvantage within the eurozone and the EU. It’s another thing, however, to actually leave these institutions.

In the next and final installment of this piece, it is the very process of leaving that will be analyzed. Contrary to a commonly-expressed sentiment that no coherent plan for a country to depart from the eurozone has ever been presented, the third and final part of this series will present some of the proposals that have been developed by economists and scholars for an orderly departure from the eurozone–and how some of the challenges and obstacles, which will inevitably be faced, may be overcome.

Top photo | Protesters hold a banner during a rally in Athens, Thursday, Dec. 8, 2016. A nationwide 24-hour general strike called by unions against austerity measures disrupted public services across Greece, while thousands marched in protest in central Athens. (AP/Yorgos Karahalis)