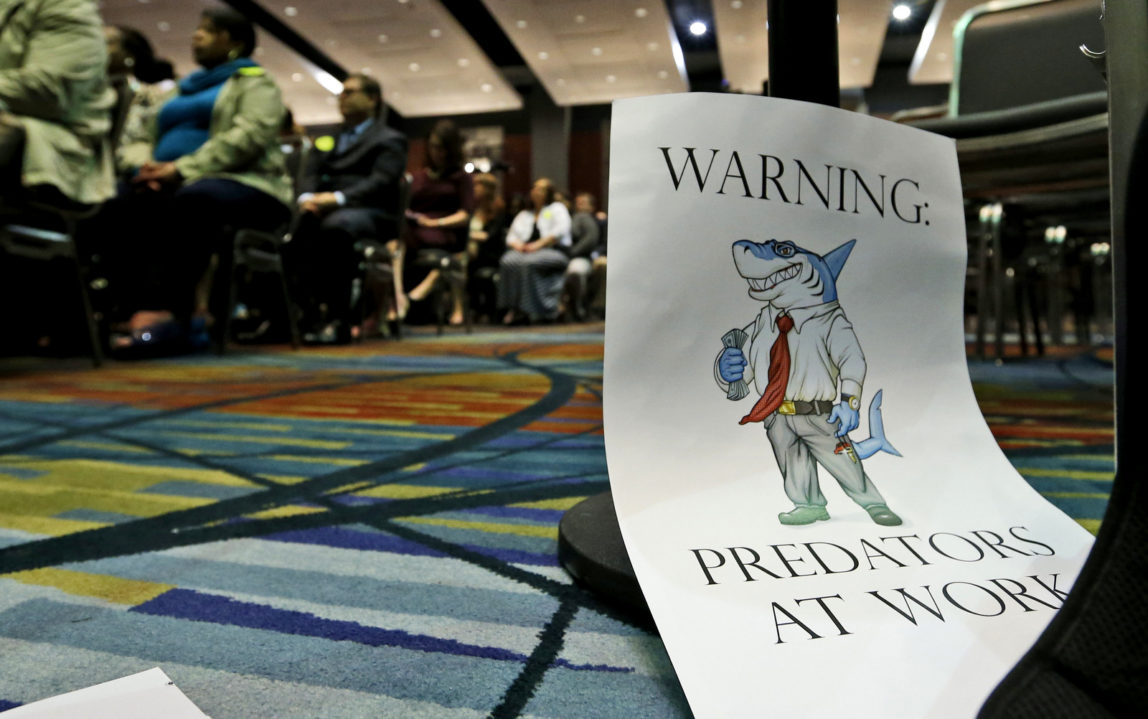

A new rule by a federal watchdog—hailed as having "paramount importance" for protecting consumers from Wall Street predators and curbing corporate abuses—is under direct attack by Republicans just days after being issued. The rule from the successful and broadly-supported Consumer Financial Protection Bureau (CFPB) bans companies from using

Republicans Attack New Consumer Protection Rules

The rule from the CFPB blocks ‘a fine-print trick that banks and predatory lenders use to evade accountability and conceal illegal behavior’