(MintPress)— The numbers are alarming: $1 billion, $1 trillion. The former is the amount of federal student loans taken out last year, the first time student borrowing has hit that benchmark over the span of one year. The latter is the total amount of outstanding student loan debt that borrowers face – again, a first.

According to Julie Margetta Morgan, a policy analyst with the Center for American Progress, the average student loan debt for a college graduate was $24,000. In 2011, the total rose to $27,000. Default rates for these loans have increased significantly, where 15 percent of borrowers at for-profit colleges defaulted in their first two years of repayment.

But what if student debt disappeared? Online efforts to forgive this debt have highlighted the movement of Michigan congressman Hansen Clark, who sponsored a bill to forgive Borrowers of their student loan debt as a means to promote economic growth in the United States. Under these efforts, the U.S. government would absorb the $1 trillion in outstanding federal loans and pay it off for borrowers. Private loans would not be covered under the measure.

Proponents of the measure argue that it would provide the best chance for economic recovery. They say that instead of funneling money to bail out financial institutions and other corporations, that money could go back to the pockets of consumers. In turn, those consumers would inject money back into the economy that they originally would have used to pay toward their student loans.

Opponents argue that the return from the initial investment would be far too small to be considered a success and that there are better ways to spend the money. Justin Wolfers, Associate Professor of Business and Public Policy at the University of Pennsylvania, wrote in a post for Freakonomics that there are other demographics that would benefit far more than those looking to alleviate their college debt.

“Notice the political rhetoric? Give free money to us, rather than ‘corporations, millionaires and billionaires,’” Wolfers wrote. “Opportunity cost is one of the key principles of economics. And that principle says to compare your choice with the next best alternative. Instead, they’re comparing it with the worst alternative. So my question for the proponents: Why give money to college grads rather than the 15% of the population in poverty?”

Where would the money come from?

The U.S. government would have to fund a $1 trillion program to erase student loan burden from borrowers. In comparison, the measure would cost $213 billion more than the 2009 federal stimulus bill approved by Obama. Morgan points out that borrowers would most certainly appreciate the excess money, but notes that it would come at the cost of a growing federal deficit.

“There is the appeal that this could boost the economy because you would be putting money back in peoples’ pockets,” Morgan said. “My sense is that [the cost] would fall on the taxpayers … so we would probably have to raise taxes or cut spending to pay for it. The long-term impact would be an increase in the deficit so it’s not immediately clear that one boost would offset the other.”

Wolfers wrote that, from a macroeconomic standpoint, the idea of widespread forgiveness is destructive to the economy because the government’s return on investment would be minuscule.

“This is the worst macro policy I’ve ever heard of. If you want stimulus, you get more bang-for-your-buck if you give extra dollars to folks who are most likely to spend each dollar,” Wolfers explained. “Imagine what would happen if you forgave $50,000 in debt. How much of that would get spent in the next month or year? Probably just a couple of grand (if that). Much of it would go into the bank.”

The prospect of doing nothing to help alleviate student loans may result in the latest bursting of a financial bubble, according to a Moody’s Analytics analysis written by Cristian Deritis. The analysis shows student loan borrowing has outpaced other forms of lending. Borrowers now owe more on their student loans than the combined amount of credit card debt in the U.S.

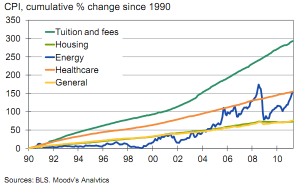

Deritis wrote: “In addition to the number of college-aged students, demand is driven by the cost of education, which has grown at an extraordinary rate over the past three decades. Based on CPI data, the cost of tuition and fees has more than doubled since 2000, outstripping the inflation rate across all goods as well as the growth rates of energy, housing and healthcare costs.”

The analysis also points out without these loans fewer students will have access to higher education, an issue that, in the long-term, could create a shortage of qualified workers.

Alternatives

With a $15 trillion dollar federal deficit, the U.S. government is unlikely to tack on $1 trillion in a lump sum. Morgan says that’s not an issue, as a complete bailout of student loans isn’t needed in the first place. She says selective forgiveness would help those who really need it and save the government from tackling the whole issue at once.

“There are people out there who have student loan debt but are repaying it and are doing fine. This kind of loan forgiveness program would forgive people of the debt who really don’t have any particular reason to do so,” Morgan said. “There isn’t the imperative like there is with the students who have graduated recently and can’t find a job or people who are long-term unemployed.”

Morgan continues by saying the government should survey and target their efforts to select students.

“You have to look at whether there are other ways to achieve lessening the burden on the students who have been the hardest hit by the economic downturn,” Morgan said. “One reason it’s not a great idea is that it’s not a particularly targeted way of reaching those students.”

Currently, there is a program to help unemployed or underemployed borrowers. Income-Based Repayment (IBR) allows for students who enroll and qualify to have lower student loan payments that are based off a percentage of their income. Jen Mishory, deputy director for Young Invincibles, a non-partisan youth advocacy organization, advocates it as an option to allow borrowers to use more of their paycheck for living costs.

“People are having to change their economic behavior because they’re spending so much of their paycheck on student loans,” Mishory said. “I’d like to see more folks taking advantage of [IBR].”

Despite available programs for borrowers to help alleviate their student loan payments, Morgan says now is a good time to look at the student loan system as a whole and fix flaws that are burying people under rising debt. She cited repayment programs, interest rates and better information for students about repayment as places to start when examining the system.

“I think we definitely need to take a hard look at the student loan program itself and see whether there are changes that need to be made,” Morgan said. “Separate from that, we need to look at the situation of graduates who are out there in the job market and struggling.”

Source: Mint Press