(MintPress)— A Javelin Strategy and Research analysis says 5.6 million Americans have moved their money from the biggest banks to different institutions over the last 90 days, part of a nationwide movement pushed by consumer and nonprofit campaigns to diminish support for entities that were “Too Big To Fail” and to “invest in Main Street, not Wall Street.”

Late last year, consumer activists made a push to encourage a mass movement from commercial banks to local credit unions by Nov. 5 in the “Bank Transfer Day” effort. Recent research has proven just how well those efforts paid off, as a Javelin analysis showed 600,000 consumers participated in the movement.

It is estimated that the top 10 banks in America could lose as much as $185 billion in deposits in 2012 because of consumers moving their money elsewhere. Consulting firm cg42 says Bank of America could be the hardest hit, potentially losing up to 10 percent of its customers and $42 billion in deposits.

The mass exodus from commercial banks has been pushed by consumer and nonprofit campaigns since the United States banking system saw a decline in solvency that prompted government intervention and bailout in 2008. The extent of the bailout has recently been reported in the trillions of dollars, a bill that was footed by taxpayers. The funding for banks came in light of accusations of predatory lending, high maintenance fees, the subprime mortgage crisis and deregulation of the financial system.

Consumer outrage

One of the first grassroots efforts to stand up against the Wall Street bailouts was the “Move Your Money” project, a nonprofit campaign that “encourages individuals and institutions to divest from the nation’s largest Wall Street banks and move to local financial institutions.” The campaign looked to diminish support for entities that were “Too Big To Fail” and to “invest in Main Street, not Wall Street.”

The movement gained support and endorsements from the likes of Representative Jan Schakowski, political pundit Bill Maher and Michael Moore. Efforts failed to initially produce results, however. It wasn’t until the Occupy Wall Street movement expressed support for the “Bank Transfer Day” effort that media coverage increased and consumers actively moved their money.

The Occupy movement became a powerful voice in vocalizing opposition toward the “too big to fail” banks and their practices prior to the bailout. They argued that top officials at America’s biggest banks were corrupt with greed and were ultimately responsible for the economic downturn seen in America today.

Occupy Wall Street says it is “fighting back against the corrosive power of major banks and multinational corporations over the democratic process, and the role of Wall Street in creating an economic collapse that has caused the greatest recession in generations.”

Bloomberg reported on the power of the banks, noting that after the bailout, bankers saw no need for financial reform for a system that had just been saved.

“Saved by the bailout, bankers lobbied against government regulations, a job made easier by the Fed, which never disclosed the details of the rescue to lawmakers even as Congress doled out more money and debated new rules aimed at preventing the next collapse,” Bloomberg reported.

Some of the money “doled out” by Congress went to Bank of America, a company that had paid its top officials more than $76 million in total compensation in 2007, the same year the first batch of government aid was sent out. Goldman Sachs gave out nearly $322 million to its higher-ups. Comparatively, JP Morgan Chase handed out nearly $95 million and Wells Fargo’s top officials took in $57 million.

.

Credit union boom

Credit unions across the country have reaped the benefits of consumer defections from U.S. banks. Banks looking to implement higher account fees for consumers were quickly reminded of the bailouts and high bonuses given to the top brass, prompting the success of “Bank Transfer Day.”

San Diego County Credit Union saw a 200 percent increase in new accounts at the tail end of last year. Teresa Halleck, president and chief executive of the San Diego County Credit Union, said, “ “I think what you are seeing are consumers who have suffered over the last year with the economy. Big banks are over the top and have pushed consumers too far.”

It’s impossible to tell how much money was transferred out of banks with the recent report of 5.6 million consumers moving their money, but if each account had a $100 balance, the total already adds up to $560 million lost by banks. If each account had a balance of $500, the total amount of money transferred would be $2.8 billion.

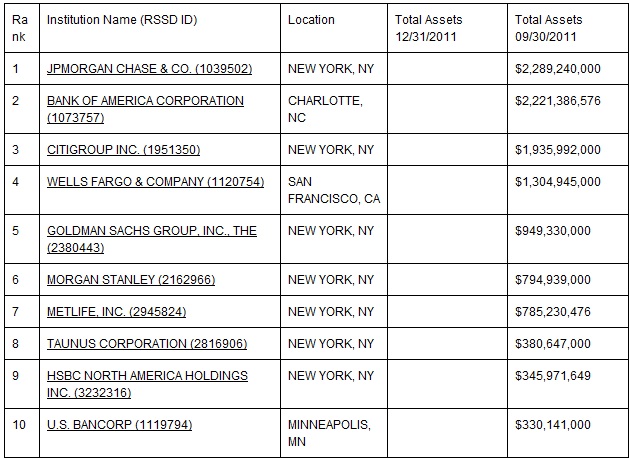

According to the National Information Center, based on data collected by the Federal Reserve System, the top 10 bank holding companies are as follows:

Source: MintPress