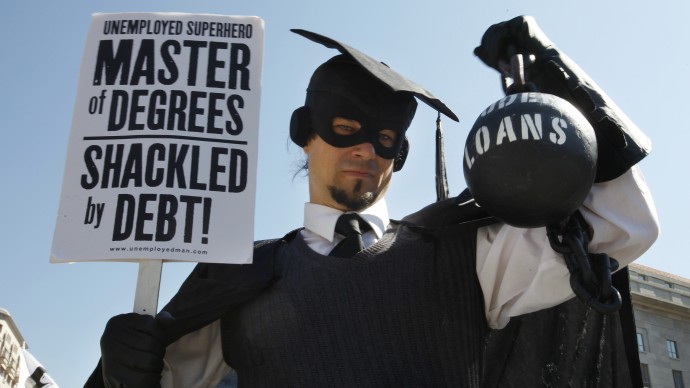

(NEW YORK) MintPress – As President Obama hits the road for his first campaign bus tour of the 2012 election season, one of the issues he is likely to address is student loan debt and whether the government should step in to ease the tremendous burden on both pocketbooks and lives.

Federal and private student loan debt surpassed credit card debt for the first time in 2010 and is expected to hit $1 trillion this year. At the same time, as graduates incur record high debt — $25,000 on average — many cannot find work because of the weak jobs market and are unable to pay back what they owe.

And the number of defaults is soaring. According to the Department of Education (DOE), among recent graduates who began repayments in 2009, 8.8 percent had already defaulted on their federal loans. That compares to 7 percent in 2008.

Tragically, the number of student loan related suicides is climbing as well. “Suicide is the dark side of the student lending crisis,” says Cryn Johanssen, Founder and Executive Director of All Education Matters.

“The public needs to be aware of how bad things have gotten for student loan debtors. This is a national emergency and it needs to be solved now.”

Anecdotal evidence

Johanssen titled one of her blogs “Suicide Among Student Debtors: Who’s Thought About It?” and says she was stunned by the responses.

“I was very actively looking into suicide until I got on anti-depressants. Now I have to take happy pills every day to keep the suicidal urges at a minimum level,” wrote one person.

“You are correct to ask the question. Many of the folks who are incredibly deep in law school debt will end up killing themselves. I think, in the next 1-3 years, we are going to see absolutely massive numbers of law school graduate suicides.”

Said another: “Yes, I thought about suicide a lot over the past few years. I take anti-depressants and I had been smoking cigarettes for months but I did end up quitting. The big issue with that is I want to be an opera singer so smoking was my way of giving up. I’m trying to do what I can to get through this… and praying for an answer.”

One person wrote, “I think about jumping from the 27th floor window of my office every day.” Another claimed that prior to writing his comment, he had been sitting in his running car with the garage door shut.

There have been similar responses to postings by a group who call themselves the Scambloggers. One came from a man who identified himself as Jordan and described his plan to light himself on fire.

“I plan to douse myself and light myself aflame on the Capitol steps, to draw attention to the dire situation of the millions of indentured educated citizens who, like me, have no options, plus a predatory banking system coming after us,” he wrote. “I will be setting myself on fire, and the student debt debacle will hopefully come to the forefront of public consciousness.”

While there is no evidence that he did in fact self-immolate, financial despair recently led a young man in Birmingham, England to set himself on fire at a claims center after a dispute about his benefits.

Says Dr. Peter Kinderman, a clinical psychologist who served on the Department of Health’s Ministerial Advisory Group in England, “There are psychological consequences when economies fall into decay. Under circumstances of severe economic stress, feeling suicidal is understandable. It is not a disease, it’s a problem.”

No legal way out

Once a person defaults on a student loan, the balance grows exponentially, with interest compounding on interest, penalties and fees.

And, unlike credit card, car insurance or even gambling debt, it is impossible to wipe the slate clean by declaring bankruptcy.

“It’s kind of strange that credit cards are dischargeable when private student loans aren’t,” said Mark Kantrowitz, publisher of the financial aid websites Fastweb.com and Fin.Aid.org. “They should be treated the same.”

They used to be, but in 2005 Congress passed the Bankruptcy Abuse Prevention and Consumer Protection Act. The legislation made it so that no student loan — federal or private — can be discharged in bankruptcy unless the borrower can prove repaying the loan would cause “undue hardship,” a condition that is incredibly difficult to demonstrate unless the person has a severe disability.

That essentially puts student loan debt in the same category as child support and criminal fines.

Now, the National Association of Consumer Bankruptcy Attorneys (NACBA) is calling on Congress to pass legislation that would allow graduates to discharge loans they took out from private lenders, including for-profit companies like banks and student loan giant Sallie Mae.

Democrats have put forward similar legislation over the past two years but have made little progress.

“There’s no way to defuse the bomb if the status quo stays the same,” said the National Association of Consumer Bankruptcy Attorneys (NACBA) Vice President John Rao.